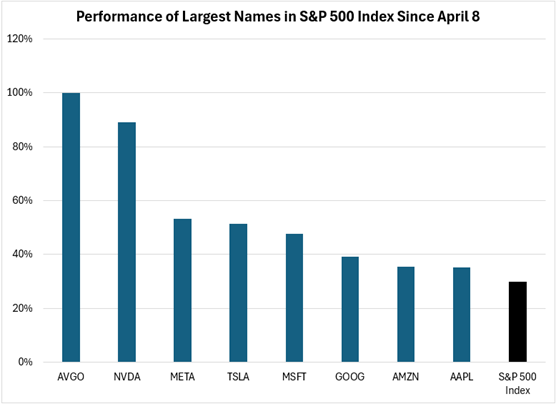

With most large-cap companies having now reported second quarter results, it’s time to reflect on both earnings season and the massive U.S. equity market rebound since the post-Liberation Day bottom on April 8. On that date, the S&P 500® Index closed below 5,000 driven by numerous concerns related to new tariffs imposed by the U.S. Administration. Credit markets began showing signs of stress while equity markets briefly entered bear market territory. Since then, the S&P 500 Index has appreciated by 30% reaching all-time highs, while second quarter earnings season reaffirmed the resiliency of the affluent U.S. consumer and re-established a sense of optimism/euphoria around the Generative Artificial Intelligence (AI) theme. The “DeepSeek moment” in January temporarily poured cold water on the idea that vast amounts of capital investment were required to deliver Gen AI innovation. However, second quarter earnings commentary across sectors was dominated by expectations of heightened spend associated with this technology. This “One Theme” has almost single-handedly driven the market recovery post-Liberation Day. Consequently, the eight largest weighted stocks in the S&P 500 Index which combine for nearly 37% of the Index have all outperformed since the market nadir.

Note: Performance through August 14, 2025.

Source: FactSet

During the market sell-off from February 19 (prior market high) through April 8, S&P 500 Index leadership showed signs of broadening. Nearly 60% of Index constituents outperformed the market during that period while Microsoft (MSFT) was the only Magnificent 71 stock to outperform. Technology was the worst performing sector following a multi-year period of significant outperformance.

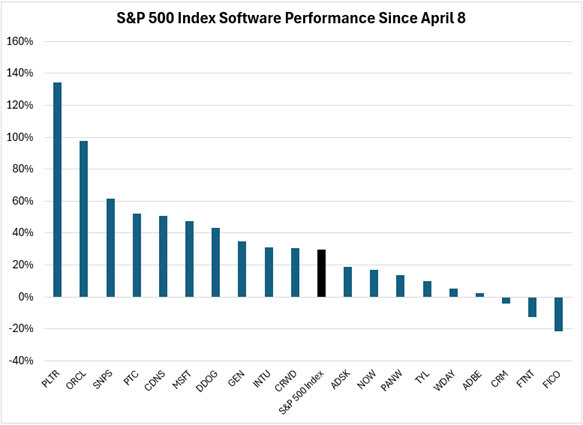

In contrast, the market recovery has been led by those companies investing heavily in Gen AI technology or those involved in the related infrastructure and compute build out. Market leadership has narrowed significantly, with only 35% of constituents outperforming the S&P 500 Index since April 8. The Industrials sector represents a microcosm of the broader market in recent months, as companies associated with either Generative AI or aerospace account for all the sector’s top 15 performers since the market bottom. Similarly, the fortunes of software stocks in the S&P 500 Index have been bifurcated between perceived Gen AI winners and enterprise seat-based SaaS models (perceived losers).

Note: Performance through August 14, 2025.

Source: FactSet

It is apropos that Palantir (PLTR), among the market’s best performers, is named after the “seeing stones” in The Lord of the Rings epic. Tolkien’s clairvoyance regarding equity markets feels almost tangible. “One Ring” to rule them all, indeed! In truth, many companies conclude that it is still very early days for Gen AI. The true immersive potential of this technology within the economy and society will play out over time. The current list of perceived winners and losers could appear very different in the future. Yet for now, the precious “One Theme” is successfully bending equity investors to its will.

Second Quarter Earnings Season Takeaways

Earnings season has been punctuated by optimism during July for many companies, reflecting an acceleration in activity post the passing of the One Big Beautiful Bill Act (OBBBA) and peak tariff concerns. Still, several economic sectors remain under pressure including many cyclical end markets and anything associated with existing home sales. China remains a weak region for many companies, while the lower end U.S. consumer continues to trade down. S&P 500 Index third quarter and fourth quarter consensus earnings per share (EPS) estimates have held steady since the end of the second quarter, projecting 7-8% year-over-year EPS growth for 2H 2025. While that level might not be strong enough to support a market trading at 22.5x forward P/E, the economically stimulative tax bill and the thawing out of M&A/capital markets activity could prove forward estimates conservative. Where rates go from here, as well as government economic data is anyone’s guess!

Below are earnings season themes supported by quotes from company management teams on earnings calls.

Data Center/Gen AI Investment and Hype are on Fire…

Ticker/Company | Comment |

|---|---|

BK/Bank of NY Mellon | “We view AI as a top line and expense story…unlocking capacity in the company.” |

GS/Goldman Sachs | “Deploying agentic AI to prioritize use cases…will significantly increase velocity.” |

PNC/PNC Fin Services | “I can give you a million ways we’re using AI…saving us a lot of money in fraud areas.” |

TSM/Taiwan Semi | “See AI demand continuing to be strong including rising demand from sovereign AI.” |

NOW/ServiceNow | “(Gen AI) is a breakthrough innovation elixir unlike anything we’ve seen in human history.” |

GOOG/Alphabet | “AI is positively impacting every part of the business driving strong momentum.” |

IBM/Int’l Bus Machines | “Our GenAI book now stands at over $7.5 billion with momentum accelerating.” |

APH/Amphenol | “AI-related products…the investments by our customers remain very, very robust.” |

JCI/Johnson Controls | “Data centers continue to be very healthy, growing very nicely.” |

AMZN/Amazon | “Continue to invest more in chips, data centers and power…unusually large opportunity.” |

AMZN (again) | “AI is the biggest technology transformation in our lifetime which is saying a lot.” |

AAPL/Apple | “AI is one of the most profound technologies of our lifetime and will affect all devices.” |

META/Meta Platforms | “Developing superintelligence, defined as surpassing human intelligence is now in sight.” |

MSFT/Microsoft | “The rate of innovation and speed of diffusion is unlike anything we have seen.” |

GNRC/Generac | “(Data centers)…far and away one of the biggest needle moving opportunities in my time.” |

DOV/Dover | “Actively increasing capacity to accommodate growing demand…data centers.” |

TT/Trane | “(Data center) capex is expected to remain high over the next several years.” |

CARR/Carrier | “With respect to data centers, continuing to build our backlog for next year and beyond.” |

ECL/Ecolab | “Data centers…we’re growing 30%, we have (unique) technology being used for cooling.” |

TSLA/Tesla | “We’ll probably have autonomous ride-hailing in half the US population by end of the year.” |

CMI/Cummins | “Continued strong demand in data centers…we have backlog out two years in that business.” |

DD/DuPont | “AI, high performance computing and data center space growing above 20%.” |

ETN/Eaton | “Orders jumped 55% and sales rose 50% in the data center market.” |

CAT/Caterpillar | “We’re planning with the largest data center customers years in advance.” |

…Despite Companies Admitting it is Still “Early Days” for the Technology

Ticker/Company | Comment |

|---|---|

WFC/Wells Fargo | “From an AI perspective, it’s very early to see any impact of any significance. It’s super early.” |

BK/Bank of NY Mellon | “It’s early days…beginning to see the benefit of some of these agents and digital employees.” |

BAC/Bank of America | “Now seeing AI capacity starting to build in the company…adds to our efficiency efforts.” |

AMZN/Amazon | “I think it is so early right now in AI…it’s very top heavy.” |

META/Meta Platforms | “We’ve begun to see glimpses of our AI systems improving themselves.” |

PNC/PNC Fin Services | “The question is whether AI is going to help you make more money or save costs.” |

MSFT/Microsoft | “Not as focused on picking a date at which revenue growth and capex growth will meet.” |

July Looks Stronger for Many Companies…

Ticker/Company | Comment |

|---|---|

UAL/United Airlines | “Book revenue…up 6% in July vs last year…double-digit acceleration in business demand.” |

DHI/D.R. Horton | “We’ve been on track and pleased with what we’ve seen into July.” |

IQV/IQVIA Holdings | “Programs are being launched because clients just can’t wait.” |

CMG/Chipotle | “Exiting the quarter we returned to a positive comp…have continued into July.” |

AAL/American Airlines | “Strengthening demand trends over the past couple of weeks.” |

ALK/Alaska Air | “Have seen a strong inflection since late June with our traffic.” |

LUV/Southwest Airlines | “Our recent bookings show clear signs of improvement.” |

URI/United Rentals | “Our customers feel good about their prospects…that has continued since early July.” |

HLT/Hilton | “People are getting out of the wait-and-see…we’re starting to see a thaw.” |

ORLY/O’Reilly Auto | “Still very early in July, but we feel good about the start of July.” |

PYPL/PayPal | “In July, I would say it’s still early but seeing a bit less pressure.” |

SWK/Stanley B&D | “Demand has picked up in July.” |

BKNG/Booking | “We definitely see some early signs of strengthening of the US market.” |

EBAY/eBay | “Our business has performed well in July, reflecting healthy consumer trends.” |

MA/Mastercard | “We’re seeing in the first four weeks of July a strengthening of the US consumer.” |

NCLH/Norwegian Cruise | “July certainly did not decelerate…will be a record month.” |

JPM/JPMorgan | “At a certain moment you have to move on with life…you can’t delay forever.” |

ABNB/Airbnb | “Encouraged by current demand trends, acceleration of nights booked April through July.” |

MNST/Monster Bev | “We look at where we are in July and all regions are increasing nicely.” |

…Nor For Many Cyclical Companies…

Ticker/Company | Comment |

|---|---|

JBHT/J.B. Hunt Transport | “Overall customer demand trended modestly below normal seasonality.” |

SLB/Schlumberger | “Land activity across N Am and LatAm have the greatest downside risk…short cycle.” |

FAST/Fastenal | “Feedback from regional leadership continues to reflect sluggish end market demand.” |

TXN/Texas Instruments | “The automotive recovery has been shallow...less pronounced and more shallow.” |

CNI/Canadian Railway | “Seeing (softness) in our forest products, metals and our autos business…to persist.” |

AVY/Avery Dennison | “Sentiment from our customers (apparel) still remains fairly muted…waiting for more clarity.” |

BKR/Baker Hughes | “We anticipate oil-related upstream spending will remain subdued.” |

DOW/Dow | “Lower for longer earnings environment…lack of clear line of sight to a recovery.” |

CSX/CSX Corp | “Forest products impacted by an overall sluggish demand environment.” |

ODFL/Old Dominion | “Continued softness in the domestic economy…not really seeing that positive inflection.” |

NOV/NOV Inc | “We think global drilling activity will slow further through the second half.” |

HAL/Halliburton | “In N Am, even large customers are now planning meaningful schedule gaps in 2H 2025.” |

EMN/Eastman Chem | “The market that’s most impacted is consumer durables.” |

NXPI/NXP Semi | “I don’t think we should sugarcoat that the auto macro environment is certainly mixed.” |

CMI/Cummins | “For 3q, we expect N Am truck demand to sharply decline from 2q levels.” |

ROK/Rockwell | “Energy, chemicals, mining and metals are all facing pressure from weak global demand.” |

EMN/Eastman Chem | “The bulk chemical story…we just have an overcapacity condition.” |

…Nor For Anything Related to Existing Home Sales…

Ticker/Company | Comment |

|---|---|

EFX/Equifax | “Hard credit inquiries down over 50% from 2015-2019 averages.” |

SHW/Sherwin-Williams | “Continue to be in softer for longer demand environment with further deterioration possible.” |

WHR/Whirlpool | “Strong correlation between discretionary demand and existing home sales.” |

MHK/Mohawk | “Mortgage rates, inflation and consumer confidence are still constraining the industry.” |

NWL/Newell Brands | “Rates remain stubbornly high depressing house formation and discretionary purchases.” |

FND/Floor & Decor | “We don’t expect significant changes in consumer behavior or housing activity in 2025.” |

FICO/Fair Isaac | “Elevated rates and affordability challenges continue to weigh on the mortgage market.” |

…Nor For Most Companies with China Exposure

Ticker/Company | Comment |

|---|---|

PEP/Pepsi | “As you think about the Chinese consumer…a little bit softer.” |

OTIS/Otis Worldwide | “Our outlook for China is now slightly lower…due to continued weakness in the market.” |

TMO/Thermo-Fisher | “In diagnostics and healthcare, revenue declined LSD as we navigated headwinds in China.” |

DHR/Danaher | “High-growth markets…solid performance was offset by MSD decline in China.” |

DOW/Dow, Inc | “Infrastructure sector…China has shown no signs of improvement.” |

HLT/Hilton | “RevPAR in China declined 3.4% largely driven by weakness in corporate travel demand.” |

JCI/Johnson Controls | “New builds in China, as has been talked about by many players is a challenging space.” |

XYL/Xylem | “Demand has been resilient – the one exception being China.” |

KLAC/KLA Corp | “Growth driven by increasing investment…partially offset by lower demand from China.” |

CARR/Carrier | “China is softer than (expected) and it’s been softer for a more sustained period.” |

DIS/Disney | “There is some stress with the China consumer.” |

Is Apple’s iPhone Competitive Moat at Risk? Give it 2-3 Years…

Ticker/Company | Comment |

|---|---|

GOOG/Alphabet | “We are super excited about our investment in glasses. An exciting new category…I still expect phones to be at the center of experience for the next 2-3 years.” |

META/Meta Platforms | “I think that AI glasses are going to be the main way that we integrate superintelligence into our day-to-day lives.” |

AAPL/Apple | “It’s difficult to see a world where iPhone is not living in it. And that doesn’t mean that we are not thinking about other things as well. But I think that the devices are likely to be complementary devices, not substitution.” |

Thanks for reading, and remember to never skip a Beat – Eric

Stocks: Alphabet (GOOG), Amazon (AMZN), Apple (AAPL), Meta (META), Microsoft (MSFT), NVIDIA (NVDA), and Tesla (TSLA), Oracle Corp (ORCL), Broadcom Inc (AVGO), Palantir Technologies Inc (PLTR), Synopsys Inc (SNPS), PTC Inc (PTC), Cadence Design Systems Inc (CDNS), Datadog Inc (DDOG), Gen Digital Inc (GEN), Intuit Inc (INTU), Crowdstrike Holdings Inc (CRWD), Autodesk Inc (ADSK), ServiceNow Inc (NOW), Palo Alto Networks Inc (PANW), Tyler Technologies Inc (TYL), Workday Inc (WDAY), Adobe Inc (ADBE), Salesforce Inc (CRM), Fortinet Inc (FTNT), and Fair Isaac Corp (FICO).

1Magnificent Seven stocks: Alphabet (GOOG), Amazon (AMZN), Apple (AAPL), Meta (META), Microsoft (MSFT), NVIDIA (NVDA), and Tesla (TSLA).

Source: FactSet®. FactSet is a registered trademark of FactSet Research Systems, Inc.

Sectors are based on the Global Industry Classification Standard (GICS®) classification system. Global Industry Classification Standard (GICS®) and “GICS” are service makers/trademarks of MSCI and Standard & Poor’s. FactSet ® is a registered trademark of FactSet Research Systems, Inc. APX® is a trademark of Advent Software Systems.

The views expressed are those of the author and Brown Advisory as of the date referenced and are subject to change at any time based on market or other conditions. These views are not intended to be and should not be relied upon as investment advice and are not intended to be a forecast of future events or a guarantee of future results. Past performance is not a guarantee of future performance and you may not get back the amount invested. The information provided in this material is not intended to be and should not be considered to be a recommendation or suggestion to engage in or refrain from a particular course of action or to make or hold a particular investment or pursue a particular investment strategy, including whether or not to buy, sell, or hold any of the securities mentioned. It should not be assumed that investments in such securities have been or will be profitable. To the extent specific securities are mentioned, they have been selected by the author on an objective basis to illustrate views expressed in the commentary and do not represent all of the securities purchased, sold or recommended for advisory clients. The information contained herein has been prepared from sources believed reliable but is not guaranteed by us as to its timeliness or accuracy, and is not a complete summary or statement of all available data. This piece is intended solely for our clients and prospective clients, is for informational purposes only, and is not individually tailored for or directed to any particular client or prospective client.

An investor cannot invest directly into an index.

The S&P 500® Index is a capitalization weighted index of 500 stocks that is designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries. Index returns assume reinvestment of dividends and do not reflect any fees or expenses. An investor cannot invest directly into an index. Benchmark returns are not covered by the report of the independent verifiers. Standard & Poor’s, S&P®, and S&P500® are registered trademarks of Standard & Poor’s Financial Services LLC (“S&P”), a subsidiary of S&P Global Inc.

Earnings per share (EPS) is calculated as a company's profit divided by the outstanding shares of its common stock.

Forward P/E Ratio is determined by dividing the price of the stock by the company's forecasted earnings per share. Morningstar is a registered trademark of Morningstar, Inc.